Some market commenters argued that necessitating details about the zero-zero alternative in ads would existing the significant risk of supplying far too much facts for buyers to digest and could only confuse people. Some business commenters also indicated that which include specifics of the zero-zero option in advertisements might not in truth permit buyers properly to find out the bottom cost loan, particularly if affiliate marketers' service fees have been addressed as upfront points and costs, but non-affiliate, 3rd-get together costs weren't. To deal with this further more difficulty and facilitate browsing on zero-zero alternate options built readily available by several creditors, the proposal also experienced solicited touch upon which costs to include within the definition of upfront points and fees, such as whether to incorporate service fees no matter affiliate status or expenses dependant on the sort of provider provided.

Once the proposal was issued, the Bureau held roundtable meetings with other Federal banking and housing regulators, customer groups, and field representatives to debate the proposal and the final rule.

Business commenters, such as small and huge establishments and trade associations, just about unanimously urged the Bureau to not finalize the earnings examination. Business opposition arose generally for three good reasons. Initial, numerous sector commenters asserted that the income exam was unduly elaborate and will be very hard to put into action. Two massive fiscal institutions stated that giant creditors would facial area troubles in calculating total profits and mortgage-relevant revenues under the earnings take a look at In case the creditor had different origination divisions or affiliate marketers or generally aggregated closed-stop and open-end transaction revenues. A national trade Affiliation representing Local community banks mentioned that Neighborhood banks would've confronted difficultly complying Together with the revenue test based upon the proposed prerequisite which the dedication of total earnings be per the reporting of Federal tax filings and marketplace connect with reviews, since, the association said, revenue from different enterprise models just isn't divided out in bank “simply call reports,” and mortgage loan revenue comes from a number of sources.

The Bureau proposed minimal specialized revisions to current remark 36(a)-4, on the other hand, to conform the language more carefully to TILA section 103(cc)(two)C) by like references to “clerical” staff and to using purposes and featuring loan terms. The proposed revisions would also explain that “manufacturing supervisors” who fulfill the definition of a loan originator would be regarded as loan originators. The Bureau even more stated while in the proposal that creating supervisors typically are supervisors of an organization (which include branch managers and senior executives) that, Besides their management duties, also originate transactions subject matter to § 1026.

As said while in the supplementary info in the proposal, the Bureau thinks the exception in TILA portion 103(cc)(2)(G) relates to servicers and servicer workers, brokers, and contractors only when engaging in specified servicing things to do with respect to a selected transaction following consummation, including loan modifications that do not represent refinancings. The Bureau said that it does not believe that the statutory exclusion was meant to protect from coverage firms that intend to work as servicers on transactions that they originate after they interact in loan origination activities prior to consummation of these types of transactions or to use to servicers of present mortgage loan debts that engage within the refinancing of such debts.

) of two different revenue-dependent bonuses for an individual loan originator Functioning to get a creditor: a “overall performance” bonus based on the person loan originator's mixture loan quantity for the calendar yr that is certainly paid out of a reward pool established with reference into the profitability of your house loan origination organization device, in addition to a yr-conclude “holiday getaway” bonus in the exact same amount of money to all business workforce that's compensated outside of an organization-broad bonus pool. As stated inside the remark, as the functionality reward is compensated out of a bonus pool that is decided with reference on the profitability with the mortgage origination small business device, it really is compensation that is set with reference to house loan-linked enterprise earnings, along with the reward is thus subject matter to The ten-% whole compensation Restrict.

(d) any overall body company in a typical Conference of which not less than twentyfive per cent. of the total voting electrical power might be exercised or managed by any these types of director, or by two or maybe more this sort of directors, with each other; or

There remain unresolved numerous critical issues concerning the look, operation, and certain consequences of adopting the zero-zero choice, which include whether disclosing the zero-zero alternate to people both pre- or publish-software or equally is in actual fact effective to individuals in purchasing a house loan and buyer comprehension ( printed web site 11373) of trade-offs; how best click here to structure advertising and marketing regulations, post-application disclosures, and the bona fide prerequisite if they are identified being valuable to consumers; along with the assessment of the results on customer and sector behaviors of another Title XIV Rulemakings and the ultimate rule being adopted under the 2102 TILA-RESPA Proposal.

And it’s plain since his administration intends to try and do almost everything it could possibly to prevent journalists from reporting factors it doesn’t like—that's most things which are correct.

the affiliate is actually a real estate brokerage that pays its real estate brokers), for getting The buyer's credit score software and undertaking other features associated with loan origination, the real estate property agent can be viewed as a loan originator when engaging in such action as established forth in § 1026.

The Bureau obtained only one touch upon this proposed revision, and that commenter favored the proposal.

Appropriately, the Bureau is adopting the compound of proposed remark 36(a)-five.iv (but codified as remark 36(a)-5.vi because of further new responses currently being adopted) as proposed, with two changes. First, comment 36(a)-five.vi references “loan originators” instead of “personal loan originators” whereas the proposal language employed these kinds of phrases inconsistently. Reference to “loan originators” is acceptable to account for the possibility that the remark could, with regards to the situation, use to your loan originator Corporation or someone loan originator. Second, comment 36(a)-five.vi now involves an extra clarification about what constitutes “bona fide” possession and equity pursuits. The proposed comment might have clarified that the time period “payment” for reasons of § 1026.36(d) and (e) will not involve bona fide returns or dividends paid on inventory or other fairness holdings. The proposed comment would have clarified further that returns or dividends are “bona fide” Should they be paid out pursuant to documented ownership or equity pursuits, if they're not functionally similar to payment, and Should the allocation of bona fide ownership and fairness pursuits In line with capital contributions is not really a mere subterfuge to the payment of payment determined by transaction conditions.

By signing up, you conform to our privacy policy and phrases of use, and also to receive messages from Mom Jones

A powerful housing market recovers should help restore the FHA's equilibrium sheet (on account of appreciation of housing rates). Sec. Donovan is getting steps to stability concerning aiding weaker sectors with the economic system get mortgage loans and buy properties devoid of hurting the FHA's precarious financial circumstance and simultaneously make sure the housing market recovers.

Angus T. Jones Then & Now!

Angus T. Jones Then & Now! Ariana Richards Then & Now!

Ariana Richards Then & Now! Dylan and Cole Sprouse Then & Now!

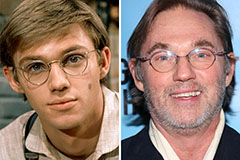

Dylan and Cole Sprouse Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now!